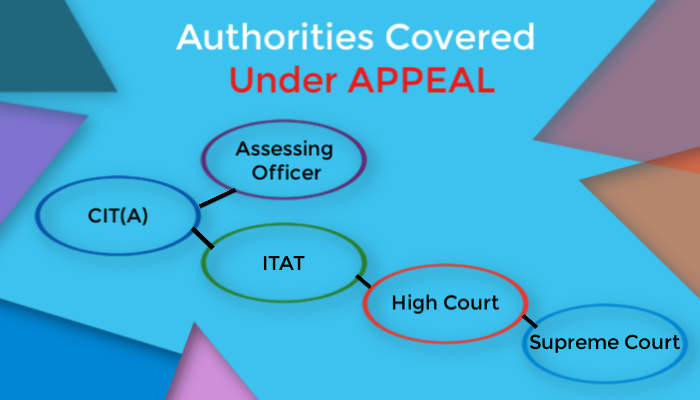

CBDT notifies Income Tax Rule 16. Application under section 158AB to defer filing of appeal

CBDT notifies Income Tax Rule 16,Application under section 158AB to defer filing of appeal before the Appellate Tribunal or the jurisdictional High Court and inserts new Form No. 8A vide…

CBIC extend dates of specified compliances related to recovery of tax and recovery of erroneous refund

CBIC extend dates of specified compliances related to recovery of tax not paid or short paid or of input tax credit wrongly availed or utilized, recovery of erroneous refund and…

Govt. extends exemption of Customs Duty and AIDC on Cotton till 31st October, 2022

The CBIC has issued notification no 38/2022 to extend the exemption of Customs Duty and AIDC on Cotton, not carded or combed falling under HSN 5201 till 31st October, 2022.…

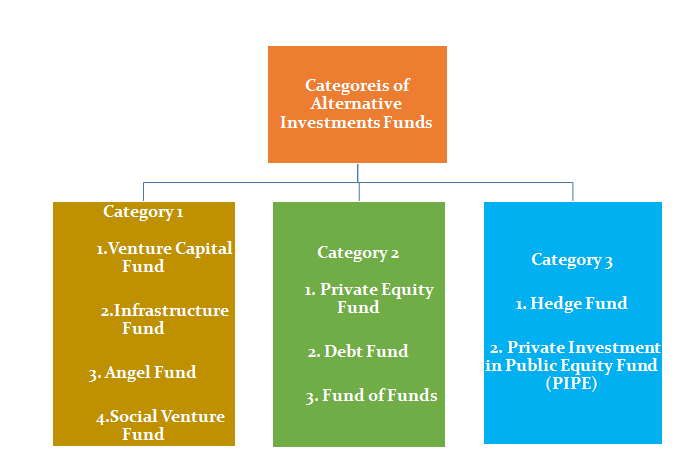

CBDT notifies new Income Tax Rule 21AL Other Conditions required to be fulfilled by original fund vide Notification No. 80/2022- Income Tax Dated: 8th July, 2022.

In a case where a capital asset is transferred to a resultant fund being a Category III Alternative Investment Fund, shall fulfil the condition that the aggregate participation or investment…

Amendment of Income Tax rule 31A and insertion of Form No. 26QF (Notification No. 73/2022 – Income Tax)

Amendment of Income Tax rule 31A and insertion of Form No. 26QF (Quarterly statement of tax deposited in relation to transfer of virtual digital asset under section 194S to be…

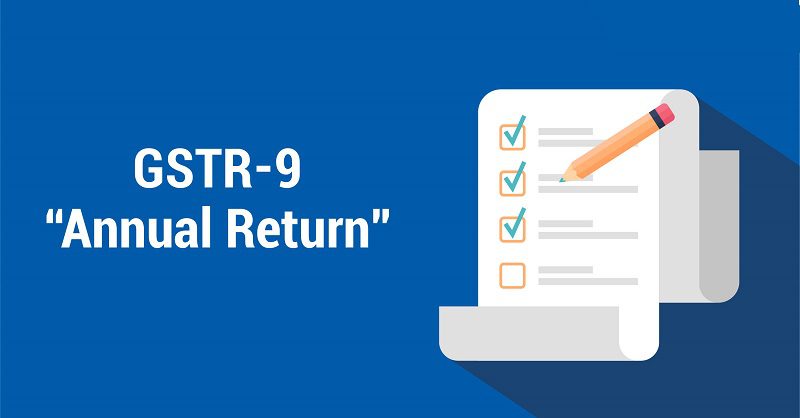

EXEMPTION FROM FILING FROM GSTR-9

CBIC exempts taxpayers having AATO up to Rs. 2 crores from the requirement of furnishing annual GST return (GSTR-9) for FY 2021-22 vide Notification No. 10/2022–Central Tax | Dated: 5th…

Mandatory e-invoicing for companies with Rs 5-crore sales from January 2023

The GST e-invoicing will likely be mandatory for firms with a turnover of over Rs 5 crore from January 1, 2023, down from the current threshold of Rs 20 crore…

LATE FEE WAIVED FOR FORM GSTR-4

As per the recent notification 07 of central GST council the late fees which was charged for form GSTR-04 has been waived from 01st May 2022 to 30th June 2022.…

Annual Return (GSTR-9)and Reconciliation Statement (GSTR 9C) for FY 2018-19

Vide notification No. 69/2020 – Central Tax, dated 30.09.2020, the due date for furnishing of the Annual Return for the FY 2018-19 has been extended till 31.10.2020. Certain representations have…

Maximum Late Fee for Form GSTR 3B has been capped.

Taxpayers please note that maximum Late Fee for Form GSTR 3B has been capped at Rs. 500 for tax period July 2017 to July 2020 subject to returns being filed…