Recommendations of 53rd GST Council Meeting

GST Council recommends waiving interest and penalties for demand notices issued under Section 73 of the CGST Act (i.e. the cases not involving fraud, suppression or wilful misstatement, etc.) for…

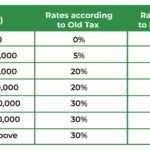

INCOME TAX SLAB RATE NEW TAX REGIME VS OLD TAX REGIME

DIFFERENCE BETWEEN OLD TAX REGIME VS NEW TAX REGIME

GST Council may review online gaming tax, bring gas & ATF under the net

The Goods and Services Tax (GST) Council will meet here on June 22, with a packed agenda, including proposals to bring natural gas and aviation turbine fuel (ATF) under the…

CBIC reduces E-invoicing limit 5 cr from existing limit of 10 cr w.e.f. August 01, 2023

The CBIC issued Notification No. 10/2023–Central Tax dated May 10, 2023 to amend Notification No. 13/2020 – Central Tax, dated March 21, 2020 with effect from the 1st day of…

Important Advisory: Time limit for Reporting Invoices on the IRP Portal

Dear Taxpayers, Thank You,Team GSTN

INPUT TAX CREDIT AND ITS AMENDMENTS

What is input tax credit? It means at the time of paying tax on output, you can reduce the tax you have already paid on inputs and pay the balance…

AMENDMENTS IN SECTION-22 & 24

23. Persons not liable for registration: Notwithstanding anything to the contrary contained in sub-section (1) of section 22 or section 24,–Section 23 of the CGST Act 2017, is all about…

Filing of manual Appeal Applications before 1st Appellate Authority

The Commissionerate of CT & GST, Finance Department, Government of Odisha has issued Notification No. CCT-PEI-POL-0155-2021-4450/CT&GST dated March 10, 2023 regarding the Filing of manual Appeal Applications before 1st Appellate…

Amendment of Section 10

Section 10- This Section provides for a registered person to opt for payment of taxes under a scheme of composition, the conditions attached thereto and the persons who are entitled,…

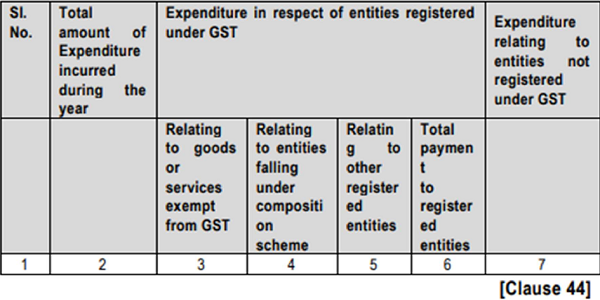

The reporting under clause 30C and clause 44 of the tax audit report (form 3CD) has been kept in abeyance till 31st March 2022.

The compliance of 44 clause was kept in abeyance till 31/03/2022 but for all the reports submitted after that date the clause is mandatory. The primary duty of submission of…