CBDT issues orders u/s 119 of IT Act,1961

CBDT issues orders u/s 119 of IT Act,1961 to mitigate hardships to taxpayers arising out of compliance of TDS/TCS provisions.

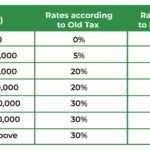

Clarification in respect of option under section 115BAC of the Income-tax Act, 1961

Section 115BAC of the Income-tax Act, 1961 (the Act), inserted by the Finance Act, 2020 wef the assessment year 2021-22, infer alia, provides that a person, being an individual or…

Rule 36(4) of CGST Rule

Rule 36(4) of CGST Rule restricts the claim of ITC in GSTR 3B. According to this rule ITC claim is restricted to 10% above the ITC as per GSTR 2A.Considering…