CBDT notifies Income Tax Rule 16,Application under section 158AB to defer filing of appeal before the Appellate Tribunal or the jurisdictional High Court and inserts new Form No. 8A vide Notification No. 83/2022- Income Tax Dated 12th July, 2022- Income-tax (Twenty Second Amendment) Rules, 2022.

Now the question arises regarding meaning of Appeal, Appellate Tribunal and Jurisdictional High Court

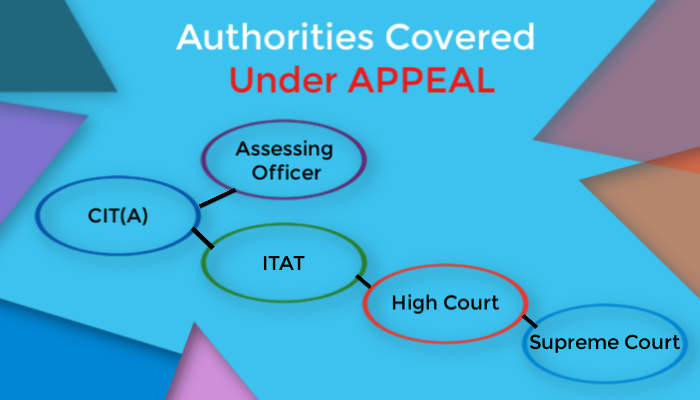

APPEAL-A tax payer aggrieved by various actions of Assessing Officer can appeal before Commissioner of Income Tax (Appeals). Further appeal can be preferred before the Income Tax Appellate Tribunal. On substantial question of law, further appeal can be filed before the High Court and even to the Supreme Court.

Appellate Tribunal is a quasi-judicial authority to file appeals against the orders of income tax authorities. A tax appeal can be filed by a taxpayer who does not agree with the assessment order or any other order, passed by an income-tax authority

Jurisdictional High Court- The High Courts in India have original and appellate jurisdiction in matters related to matrimony, fundamental rights, and cases that were transferred from a lower court.

https://cacmacsyouth.com/wp-content/uploads/2022/07/notification-83-2022.pdf