In a case where a capital asset is transferred to a resultant fund being a Category III Alternative Investment Fund, shall fulfil the condition that the aggregate participation or investment in the original fund, directly or indirectly, by persons resident in India shall not exceed five per cent. of the corpus of such fund at the time of such transfer, upto 5% capital gain on transfer is exempt under this category.

NOW THE QUESTION ARISES REGARDING ORIGINAL FUND, RESULTANT FUND AND ALTERNATIVE INVESTMENT FUND

ORIGINAL FUND

A fund established or incorporated or registered outside India, which collects funds from its members for investing it for their benefit and with some conditions.

RESULTANT FUND

A fund established or incorporated in India in the form of a trust or a company or a limited liability partnership

ALTERNATIVE INVESTMENT FUND

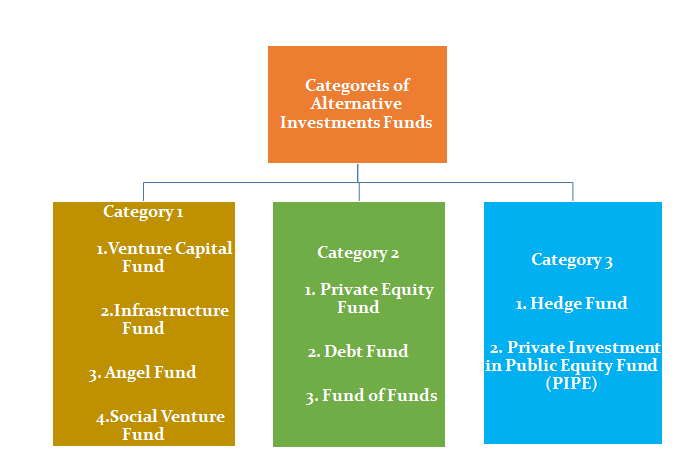

Any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

http://cacmacsyouth.com/wp-content/uploads/2022/07/notification-80-2022.pdf