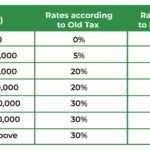

CBIC reduces Mandatory E-Invoice for Businesses having Rs. 20 Cr Turnover to Rs. 10 Cr

Till, in March, the Board had enabled the facility to Registration and Login for Taxpayers with Turnover Rs. 20 to 50 crores and notified the reduction in the Applicability of…

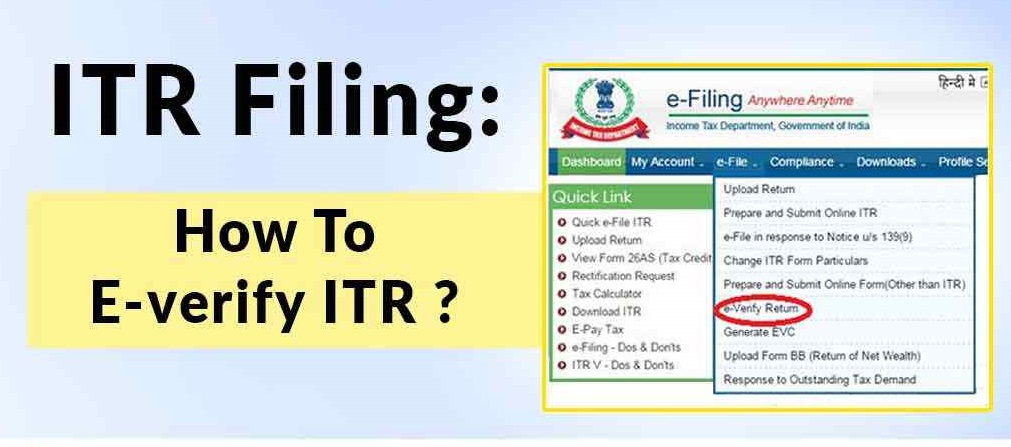

ITR-V submission: Time limit for verifying ITR reduced from 120 days to 30 days

The CBDT said that E-verified/ITR-V submitted after 30 days, will be considered as ‘Delayed filing’ and not Invalid ITR. The CBDT has announced that the time limit for verifying an…

CBDT directs ASK (Aaykar Seva Kendra Centres) to remain open on July 31, 2022 during normal office hours to facilitate filing of tax returns.

The order no F.No 225/125/2022-ITA.II dated July 30, 2022 issued by CBDT to directed the ASK centres throughout the India to remain open on July 30,2022 during normal office hours…

Breaking: Supreme Court directs to Open GST portal for claiming Transitional Credit for two months

FOR GST TAX PAYERS the Supreme Court has directed to open the GST system enabling to claim transitional credit for 60 days from 01.09.2022 till 30.10.2022. Earlier, various High Courts…

GOVT IS NOT CONSIDERING TO EXTEND THE LAST DATE OF INCOME TAX RETURN

Revenue Secretary Tarun Bajaj on Friday said the government is not considering extending the July 31 deadline for filing the income tax return (ITR), according to news agency PTI. So,…

Income Tax – Condonation of delay under Section 119(2)(b) of the Income-tax Act, 1961 in filing of Form No. 10B for Assessment Year 2018-19 and subsequent years.

The settled legal position uptill now is that for availing exemptions from tax the following conditions must be fulfilled: 1) The assessment proceedings could be said to be pending even…

GST Impact on Rental Income of a Residential House Property has given to a registered person

GST Impact on Rental Income of a Residential House Property has given to a registered person (Under GST) under GST Law w.e.f. 18.07.2022.When a tenant is registered and takes a…

TDS on benefit or perquisite of a business or profession – Section 194R of Income Tax Act 1961

Section 194R casts an obligation on the person responsible for providing any benefit or perquisite to a resident, to deduct tax at source @10%. There is no further requirement to…

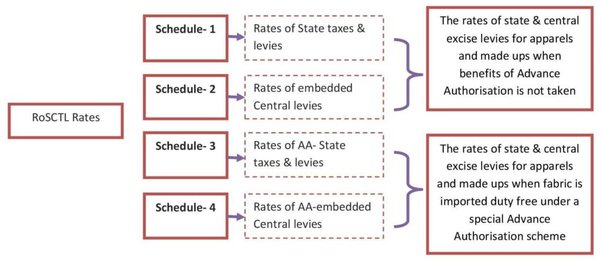

Centre extends RoSCTL scheme till March 31, 2024 for export of apparel/garments

After the introduction of GST in 2017, the RoSL (Rebate of State Levies) scheme was replaced by a new scheme – Rebate of State and Central Taxes Levies (RoSCTL) in…

ITC utilisation allowed before Rule 86B

ITC (INPUT TAX CREDIT) plays a very important role in GST by avoiding cascading effect of taxation. The input tax credit available in the electronic credit ledger could always be…