The compliance of 44 clause was kept in abeyance till 31/03/2022 but for all the reports submitted after that date the clause is mandatory. The primary duty of submission of the details is of Auditee and for verification of the information supplied under this clause can be verified form the GSTR-2A, GSTR-2B, AIS and other records available with the dealer.

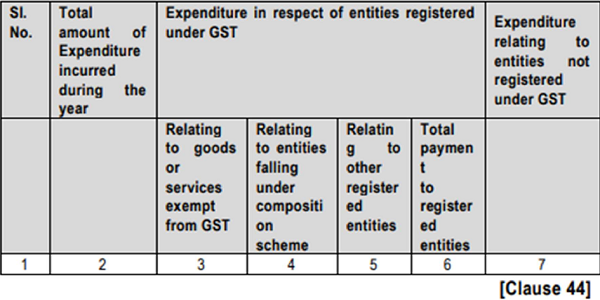

Clause 44 requires a taxpayer to provide a break-up of expenditures made to GST registered entities/Non-GST registered entities i.e. Outgoing Expenses. Hence, disclosure in Clause 44 will be applicable to all the assesses who are subjected to tax audit u/s 44AB irrespective of the fact whether they are registered under GST or not.

Most of the information required for this clause is already available in the form of GSTR-2A and AIS because most of the Expenditures on which GST has been paid is already available on records and rest is Exempted and Non-GST payers. In most of the cases what is the use of this new information in Form 3CD is better known but since the clause is there hence the Assesses and Auditor has to comply with it.

https://cacmacsyouth.com/wp-content/uploads/2022/08/circular_no_5_2021.pdf