Clarifications on provisions of the Direct Tax Vivad se Vishwas Act, 2020

During the Union Budget, 2020 presentation, the ‘Vivad se Vishwas’ Scheme was announced to provide for dispute resolution in respect of pending income tax litigation. Pursuant to Budget announcement, the…

CBDT revising Income Tax Return(ITR) Forms

CBDT revising Income Tax Return(ITR) forms to enable taxpayers to avail benefits of timeline extension due to Covid-19 situation.

CBIC launches Electronic Communication of PDF based Gatepass and OOC Copy of Bill of Entry to Custom Brokers/Importers

In order to mitigate the unprecedented situation due to Covid-19 pandemic, CBIC hastaken a number of measures to facilitate & expedite Customs clearance process making it more and more contact-less…

Clarification in respect of certain challenges faced by the registered persons in implementation of provisions of GST Laws

Circular No.136/06/2020-GST, dated 03.04.2020 had been issued to clarify doubtsregarding relief measures taken by the Government for facilitating taxpayers in meeting the compliance requirements under various provisions of the Central…

Relaxation of provisions for Account holders of PPF, Sukanya Samriddhi Account (SSA) and RD.

Relaxation of provisions for Account holders of PPF, Sukanya Samriddhi Account (SSA) and RD.Govt has taken the decision to safeguard interests of small savings depositors in view of the lockdown…

MCA has issued COVID-19 related Frequently Asked Questions (FAQs) on Corporate Social Responsibility (CSR)

The Ministry has been receiving several references/ representations from various stakeholders seeking clarifications on eligibility of CSR expenditure related to COVID-19 activities. In this regard, a set of FAQs along…

Basic Customs Duty and Health Cess Exempted on import of ventilators.

Basic Customs Duty and Health Cess Exempted on import of ventilators and other items in response to the COVID-19 situation.

CBDT provides clarification on orders u/s 119 of the Income – tax Act, 1961.

With a view to further mitigate the hardships to taxpayers, CBDT provides clarification on orders u/s 119 of the Income – tax Act, 1961 issued recently, relating to issue of…

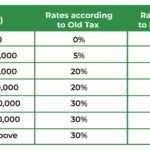

Relief provided to taxpayers in view of Covid-19 pandemic

Relief provided to taxpayers in view of Covid-19 pandemic. Taxpayers having aggregate turnover more than Rs. 1.5 crores and upto Rs. 5 crores in preceding FY For more details, please…

Circular DGFT extends the time limit by granting one time condonation under the EPCG Scheme till March 31, 2021

The DGFT vide Public Notice No. 01/2015 – 20 dated April 07, 2020, which further extends the time limit to receive the requests in RAs for block-wise extension and further…